Issues related to digital tax collection and evasion

Major online corporations are generating profits from providing digital services in countries where they lack tax residency, subsequently channeling these earnings to jurisdictions with lower tax rates, impeding local governments’ ability to collect their due taxes.

Illegal importation and/or reporting of mobile devices actual values deprives the nation from collecting accurate taxes on customs including VAT.

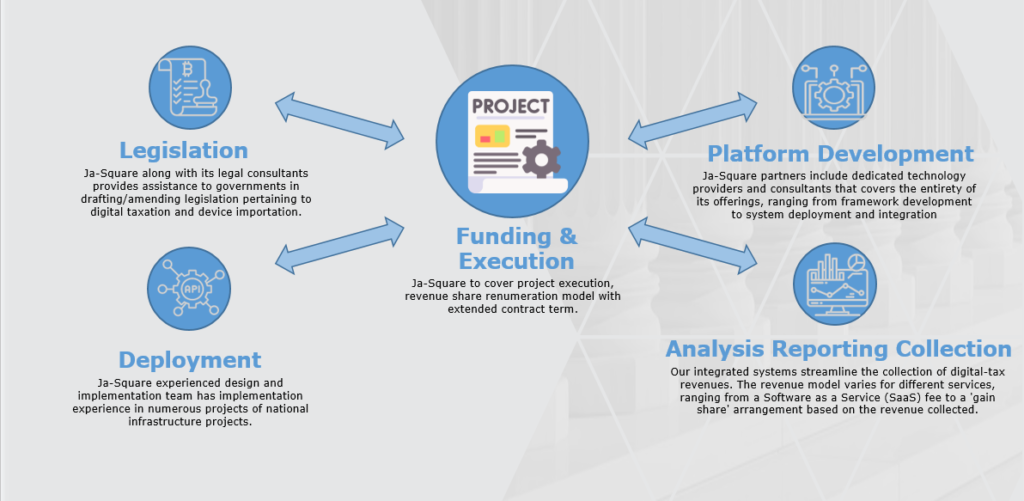

Ja-Square proposes an end-to-end solution focusing on digital services and VAT collection.

Comprehensive solution tailored for governments to streamline the process of collecting taxes on digital services and other sectors.

Secure framework that will integrate with digital service providers, gathering online expenditure data and applying taxation at the relevant tax rates.

A revenue-share model where Ja-Square shares in the collected Tax proceeds with government.

Capex, Opex or Software as-a-Service (SaaS) modeling or enabling Governments to have full autonomy and discretion.

A highly skilled consortium with extensive expertise in digital services monitoring and platform deployment.

Global Perspectives on the Information and Telecommunication Market: Trends, Challenges, and Opportunities

Many countries have experienced significant growth in digital services and cryptocurrency recently, fueled by the expansion of mobile telephony and internet access, which has played a crucial role in their economic and social development.

Digital Services:

- The digital services sector, particularly e-commerce, is poised for significant growth in many countries, driven by factors such as increased internet penetration and the widespread adoption of mobile devices.

- Mobile e-commerce, in particular, is experiencing a surge in popularity, with a growing number of consumers turning to mobile platforms for their online shopping needs.

- This trend underscores the evolving landscape of consumer behavior and presents new opportunities for businesses to leverage digital channels for commerce and growth.

Crypto Currencies:

- Cryptocurrency transactions are on the rise globally, with significant volumes relative to national incomes.

- Bitcoin, Ether, and other popular currencies are actively traded, serving purposes beyond mere investment, including peer-to-peer transactions and hedging against economic instability.

- Surveys reveal growing interest in cryptocurrency investment across diverse countries, emphasizing their increasing relevance in the contemporary financial landscape.

The number of active internet and broadband users in many countries is substantial, with broadband penetration showing significant coverage.

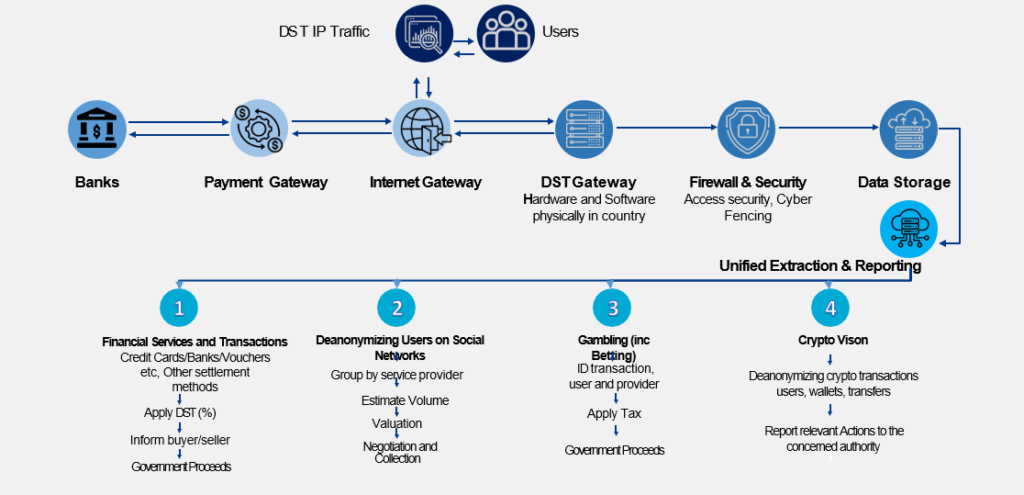

Our Integrated DTS Platform initially focuses on four primary verticals…

Ja-Square Offering

Ja-Square with its consultants and systems providers manages all the key components required for a successful implementation.

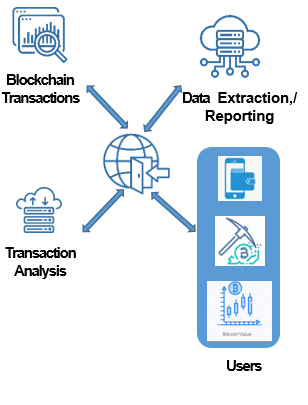

Ja-Square proposes a DST platform interaction with several Government Gateways

Crypto Vision- Cryptocurrency Transaction Deanonymization

The Platform detects all the cryptocurrency transactions in any network. It allows Law Enforcement to identify the end sender and receiver, recognise the owners of crypto wallets, and track money flows.

- Object search (obtaining a phone number, IP traffic by crypto wallet address)

- Mass search by Crypto-Transaction amounts

- Crypto Vision allows to find a list of all wallet owners with any given transaction amount, including miners

- Bulk search by wallet tags (OSINT platforms tag crypto wallets involved in criminal or fraud activities)

- Mass search by number tags (Law enforcement agencies keep records of objects of interest. By lists of uploaded phone numbers and IP addresses.

Capturing and accumulating user actions on any Network